Market Overview - NIGERIA

Why Nigeria ?

Nigeria is one of Sub Saharan Africa’s largest economies. Its GDP in 2017 was estimated at USD376.4 billion. It was a decline compared to preceding years (2014, 2015 and 2016), primarily because of decline in oil prices. The economy of Nigeria has not been doing well over the last few years. Data show that during the period 2010-2016, its GDP has increased by about 10 percent, from a level of USD 369 billion in 2010. However, during the intermittent year such as 2014, Nigeria registered significant growth in its GDP, when it was valued at over USD 568 billion.

Nigerian economy relies heavily on oil as its main source of foreign exchange earnings and government revenues. Within the economy, services are the largest sector of the economy, accounting for about 50 percent of total GDP. Agriculture, which in the past was the biggest sector, now weights around 23 percent. Crude Petroleum and Natural Gas constitute 11 percent of total GDP. Industry and Construction account for the remaining 16 percent of GDP.

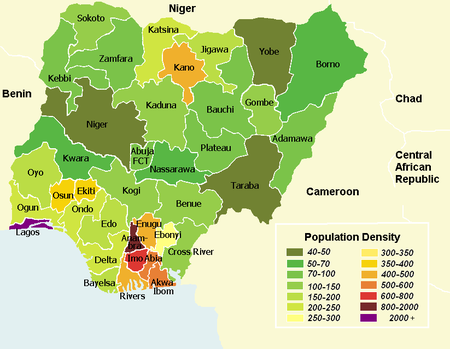

The commercial hub of the country Lagos has over 21 million inhabitants and is the largest city in Africa, in fact, Lagos State’s GDP is $131 billion in its own right, making it the 6th largest economy in Africa.

Sector Overview

The manufacturing industries in Nigeria is an economic sector that brings approximately 10 percent of total GDP (Gross Domestic Product) each year. Manufacturing activity is concentrated in large cities like Lagos, Port Harcourt, and Ibadan, in the south of the country. Millions of people are involved in producing household goods, consumer products, automobiles, agriculture, mining, cement and building materials etc. The Nigerian manufacturing sector is dominated by the production of cement and building materials, food and beverages, tobacco, chemicals and fertilizers, wood, and textiles. Out of all only 3 subsectors (food & beverage, cement, and textile) account for 77% of manufacturing output generating the greatest value. Also, breweries and flour mills contribute well in the manufacturing sector.

Performance of the sector

The Nigerian manufacturing sector has been performing well in recent years as compared to previous years. The incentives by the government are also beginning to encourage greater interest, to encourage more output in manufacturing sector the government has been making it cheaper for consumers to purchase locally manufactured goods, making the foreign alternatives prohibitively expensive or totally unavailable through import bans, facilitation of cheaper funding, discriminatory foreign exchange policies, and so on.

Challenges

Manufacturing in Nigeria is beset with quite a few challenges, chief among them is power supply, most firms rely on “emergency” power generators to run seamless operations eventually adding to costs. The country’s physical infrastructural deficiencies are also a major constraint, difficult access to credit, and the cost of imported raw materials and skilled labor being the additional challenges.

Current Scenario

The global supply chain has been deeply disrupted as China, which is the second largest economy in the world, is a major supplier of inputs for manufacturing companies around the world, Nigeria inclusive. Many manufacturers and service providers in the country are already experiencing acute shortage of raw materials and intermediate inputs. This has implications for capacity utilization, employment generation and retention and adequacy of products’ supply to the domestic market.

Future of manufacturing in Nigeria post COVID19 pandemic

The COVID19 pandemic has already accelerated several consumer trends, what most of us consider normal has already fundamentally shifted. Manufacturers in Nigeria who would understand and act on this new normal will have ample opportunities for growth. The COVID-19 pandemic hit manufacturers in an unexpected and unprecedented way. For the first time in modern Nigerian manufacturing history, demand, supply, and workforce availability are affected globally at the same time. Only those companies that provide and deliver vital goods like personal care, FMCG, beverages, paper and pharmaceutical etc. are struggling to meet demand driven by panic buying while other manufacturers of non-essential items are experiencing dramatic drops in demand and extreme pressure to cut operational costs.

Those countries which were dependent on offshore supplies for basic needs are now seeing the downside. Now, Governments are almost certain to use domestic manufacturing as part of their plan to build up strategic resilience in the aftermath of the current crisis. Hence, there will be ample of opportunities for the people willing to work into manufacturing sector and Nigeria indeed has the population and human capital capabilities. Beyond population, Nigeria needs a critical ingredient to make use of the chance to succeed presented by this pandemic.

Anticipated trends to the industry

Automation will be a key component of the effort to revive domestic manufacturing. Automated manufacturing will not only bring back demand for low-skilled labor but will create many new jobs and opportunities for digitally savvy workers.

Learning from the current manufacturing scenario, manufacturing sector will be undergoing new trends like a more elastic workforce, digitally enabled workplace, differentiated supply chains by customer segment, resilient and distributed IT infrastructure/ systems, more digital channels, and E-commerce platforms.

Job opportunities in the manufacturing sector in Nigeria

We anticipate a continuing demand for skilled talent in the manufacturing sector. Furthermore, there will be a greater demand for engineers, automation experts, digital specialist and E-commerce executives. With the growth in demand for basic FMCG products, supply chain experts in the country will be in high demand as well.

Source: Select Global Solution